Regal Insurance Brokers

Expert guidance and personalized coverage to protect what matters most to you.

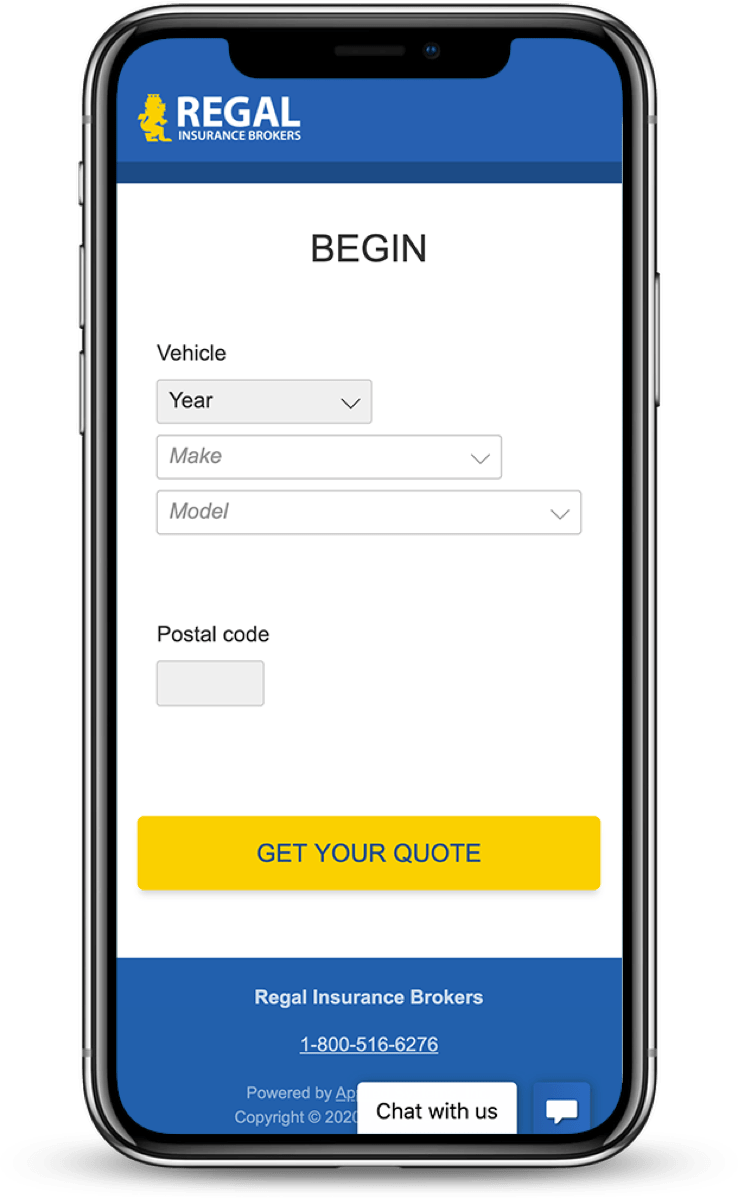

Get A Quote

Get the Best Auto, Home, and Business Insurance Rates in Ontario

We make it easy to find the right coverage for your needs—whether you're protecting your car, safeguarding your home, securing your business, or ensuring your family’s future with life insurance.

Auto Insurance

Life Insurance

Property Insurance

Travel Insurance

Business Insurance

Why Choose Regal Insurance Brokers?

At Regal Insurance, our pariority is securing the best coverage at the best value for you. When you choose us, you benefit from

Affordability

Affordable Insurance for All Needs

We work with a wide network of leading insurers across Ontario, ensuring you get competitive rates and comprehensive coverage. With more options at your fingertips, you can always count on finding the best price for your insurance needs.

Availability

Accessible and Convenient Service

Your convenience is our priority. Whether you prefer chatting online, talking over the phone, or video conferencing, your broker is always available. Plus, our 24/7 online portal offers easy access to your policy documents and after-hours claims support.

Advice

Personalized, Expert Coverage Advice

When you reach out for guidance, you’ll speak directly with a licensed RIBO broker who understands your needs. No automated systems or middlemen—just real experts providing tailored solutions.

Convenience

Trusted Advisors at Your Service

We know your time is valuable, so we’ve streamlined the process with digital documents, e-signatures, and hassle-free online payments, making it simple to manage your policy whenever it’s convenient for you.

Our Insurance Process: Simple, Fast, and Tailored to You

We Ask You Some Questions

We Compare Multiple Quotes

We Find the Best Coverage for You

Get your home quote today!

Connect with our brokers for customized insurance solutions that outdo big providers. Specializing in Ontario commercial insurance, we compare Canada’s top insurers to ensure you receive the right coverage at the best possible price.

Fill out this short form and get your free, no-obligation home quote today!

Why Compare Insurance Rates From Different Companies?

There are several reasons why you should compare insurance rates from different companies:

Coverage varies by insurer

Each insurance company offers different types of protection, endorsements, and plans. By comparing rates, you can ensure that you are getting the coverage that best fits your needs.

Premiums differ for each provider

Insurance companies use different formulas to calculate premiums, taking into account various factors. By comparing rates, you can find the most affordable option for your specific circumstances.

Different insurers offer different discounts

By comparing rates, you can discover which companies offer the most savings opportunities based on your individual circumstances, such as safe driving record, bundling policies, or having certain safety features in your home.

Insurers are competing for your business

Insurance companies operate independently and are constantly competing to attract customers. This competition can work to your advantage, as it can lead to lower rates and better deals.

Make an informed choice

Insurance rates can vary significantly between companies. By comparing rates, you can see what each insurer is offering and make an informed decision based on your specific needs and budget. This allows you to choose the insurance policy that provides the best value for your money.

An insurance broker is a professional who serves as an intermediary between insurance companies and individuals or businesses seeking insurance coverage. They work on behalf of their clients to find the best insurance policies and coverage options that meet their specific needs and budget. Insurance brokers have in-depth knowledge of different insurance products and companies, and they provide expert advice and guidance to help their clients make informed decisions. They also assist with claims processing and provide support throughout the insurance policy lifecycle

- Working with an insurance broker instead of buying insurance directly from an insurer offers several advantages. Firstly, an insurance broker is an independent professional who works for you, not the insurance company. They have access to a wide range of insurance products from different insurers, allowing them to find the best coverage options that fit your specific needs and budget.

- Insurance brokers have industry expertise and knowledge. They can explain the terms and conditions of different insurance policies, help you understand the coverage limits, and guide you through the insurance buying process. They can also provide advice on the appropriate types and amounts of coverage for your specific situation.

- Insurance brokers act as intermediaries between you and the insurance company. They can assist you in filling out applications, submitting claims, and communicating with the insurer on your behalf. This can be particularly helpful in case of complex or disputed claims, where the broker can advocate for your interests and help resolve any issues.

- Insurance brokers work for you, not the insurance company. Their primary responsibility is to serve your best interests and find the most suitable insurance coverage for you. They can provide ongoing support and advice, review and update your policies as your needs change, and assist you in navigating any changes or renewals.

- When selecting the best insurance products for your needs, Regal Insurance insurance brokers take several factors into consideration. Firstly, we will assess your specific insurance needs by conducting a thorough evaluation of your personal or business situation. This may involve reviewing your assets, liabilities, income, and any potential risks you may face.

- Once we have a clear understanding of your needs, our insurance brokers will search for insurance products from top insurance providers in Canada. They will compare different policies, coverage options, and premiums to find the best match for your requirements.

To get a quote from an insurance broker, you will typically need to provide certain information. The specific details may vary depending on the type of insurance you are seeking, but here are some common pieces of information that insurance brokers may ask for:

- Personal Information: This includes your name, date of birth, address, and contact information.

- Details about the insured property or individual: If you are seeking insurance for a property, you may need to provide information such as the address, size, construction type, and any unique features of the property. If you are seeking personal insurance, you may need to provide details about your health, lifestyle, or driving history.

- Coverage and policy preferences: You should be prepared to discuss the type and level of coverage you are looking for. This may include the desired coverage limits, deductible amounts, and any specific policy features or endorsements you are interested in.

- Current insurance information: If you already have insurance coverage, the insurance broker may ask for details about your current policy, including the insurance company, coverage limits, and expiration date.

- Claims history: Insurance brokers may inquire about your claims history, including any past insurance claims you have made. This helps them assess the level of risk associated with insuring you.

- Additional information: Depending on the specific type of insurance you are seeking, the insurance broker may ask for additional information. For example, if you are seeking auto insurance, they may need details about your vehicle(s) such as make, model, and year.

Insurance brokers assist clients with filling out applications, submitting claims, claims processing, and communicating with the insurer on your behalf. They provide support throughout the insurance policy lifecycle. Insurance brokers can be particularly helpful in case of complex or disputed claims, where the broker can advocate for your interests and help resolve any issues.

- Check their license: You can verify if an insurance broker is licensed by contacting your state’s insurance department or regulatory agency to find more information on the broker’s license status and any disciplinary actions taken against them.

- Research their reputation: Look for reviews and testimonials from clients who have worked with the insurance broker. You can check online review websites, social media platforms, and industry forums to get an idea of their reputation. Additionally, you can ask for recommendations from friends, family, or colleagues who have had positive experiences with insurance brokers.

- Look for professional affiliations: Reputable insurance brokers often belong to professional organizations or associations. These affiliations can indicate that the broker is committed to maintaining high ethical standards and staying updated on industry trends. You can check their website or inquire directly about their affiliations.

- Request references: Don’t hesitate to ask the insurance broker for references from their past clients. Contacting these references can give you insights into the broker’s professionalism, knowledge, and customer service.

- Seek transparency: A reputable insurance broker should be transparent about their fees, commissions, and any potential conflicts of interest. Make sure you understand how they are compensated and if they have any affiliations with specific insurance companies.

Your Policy Documents Are Available Online

We give clients 24/7 access to their policy documents, proof of insurance, billing, and more.

Ready to Save Money On Insurance?

Protect what matters most with personalized insurance coverage from Regal Insurance. Our licensed brokers offer expert advice and tailored plans to fit your needs. Contact us today to secure your home, auto, or personal assets with comprehensive protection. Get A Quote

Looking for Business Insurance?

Find out how we can help with your business insurance needs.

Stay Informed with Expert Insurance Insights

The Hidden Costs of Owning a Car in 2025

Yes, beyond the purchase price, owning a car in 2025 comes with many hidden costs—including depreciation, financing interest, insurance, maintenance and repairs, subscriptions, parking, tolls,...

Are Tariffs Making Car Insurance More Expensive in Ontario?

Tariffs don’t directly raise your auto insurance premiums, but they do make car repairs more expensive—and higher repair bills often translate into higher insurance rates....

Are Keyless Cars More Likely to Be Stolen in Ontario?

Yes, studies show that keyless cars are more likely to be stolen in Ontario due to “relay attacks,” where thieves amplify your fob’s signal to...